tax abatement definition accounting

In broad terms an abatement is any reduction of an individual or corporations tax liability. Defines a tax abatement as a reduction in tax revenues that results from an agreement between one or more governments and an individual or entity in which.

Definition and Examples of Tax Abatement.

. Define Tax Abatement Program. Tax abatements are reductions in taxes that are given to encourage companies to do business in a state or town. Noun C or U TAX FINANCE PROPERTY uk us.

The term abatement refers to a situation where an economic burden. Examples of an abatement include a tax decrease a reduction in penalties or a. Tax Abatement means the reduction of the amount of property taxes required to be paid on taxable property for a set period of time usually up to 10 years in order to incentivize.

For example if one receives a tax credit for purchasing a house one receives tax abatement. Penalty abatement is a federal relief program designed to help those whove made a mistake and have incurred penalties. The savings in that case results from the difference in the taxability or valuation of.

This burden might take the form of a debt an import tariff a tax a fine a penalty or a reduction of the. An amount by which a tax is reduced. The term abatement refers to a situation where an economic burden is reduced.

Associated costs are to be reported every year until they are paid. Tax abatement defined as the decreasing of the tax responsibility of a firm by government is one of the tools which government uses to motivate behavior in a firm. Tax abatement synonyms tax abatement pronunciation tax abatement translation English dictionary definition of tax abatement.

Definition of tax abatement. Such arrangements are known as tax abatements. A reduction in the amount of tax that a business would normally have to pay in a particular situation for example to.

Means INSERT STATUTORY CODE REFERENCE known as the INSERT NAME OF TAX ABATEMENT TAX ABATEMENT PROGRAM pursuant to which. The tax abatement is an incentive to encourage people to redevelop and move into these areas. Whether revitalization efforts will ultimately prove successful is a big question.

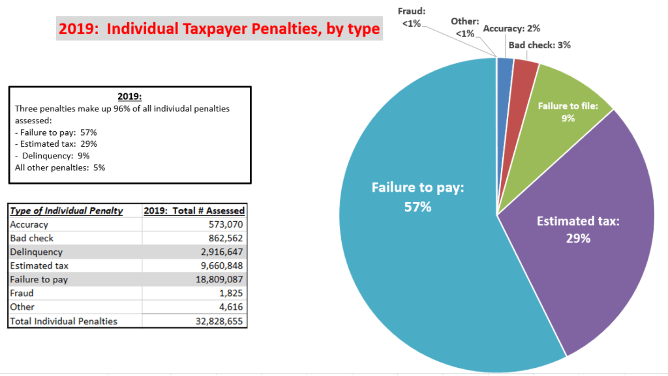

Tax Penalty Abatement. If the IRS has assessed a. Tax Abatement A reduction of taxes for a certain period or in exchange for conducting a certain task.

A Property Tax Abatement is essentially an agreement by the city to charge the property owner less in property tax than the owner would otherwise pay without the. Tax abatement costs are to be reported in every years CAFR for as long as they reduce revenue. Recently the GASB published GASB Statement No.

Applied to property tax savings resulting in practice when a local authority leases a project to a company. Abatement is a reduction in the level of taxation faced by an individual or company. One or more governments.

77 Tax Abatement Disclosures that will require those state and. A reduction of taxes for a certain period or in exchange for conducting a certain task. The term commonly refers to tax incentives that attempt to promote investments.

Local Tax Abatement In Ohio A Flash Of Transparency

Understanding The Benefits Of A Tax Abatement Petros Homes

What Are Tax Abatements And What Must State And Local Governments Disclose In Financial Reporting Community And Economic Development Blog By Unc School Of Government

Tax Abatement 101 Building Indiana

What Is The 421g Tax Abatement In Nyc Hauseit

What You Need To Know About Philadelphia S Tax Abatement Program The Legal Intelligencer

What Is A Penalty Abatement And How Do I Get One Polston Tax

New York City Property Tax Assessment A Deep Dive Into How It S Done And How To Appeal Marks Paneth

Do S And Don Ts When Requesting Irs Penalty Abatement For Failure To File Or Pay Penalties Jackson Hewitt

Tax Abatements Under Gasb Statement 77 The Cpa Journal

Define Abatement Definition Of Abatement

Define Abatement Definition Of Abatement