new mexico pension taxes

You are 65 or. Taxpayers 65 years of age or older may be eligible for an income tax deduction of up.

Nm Educational Retirement Board Managing The Assets Of New Mexico S Educators Since 1957

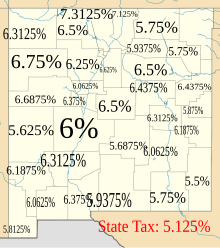

Like the federal tax system the Land of Enchantment uses brackets.

. Retirement income exclusion from 35000 to 65000. New Mexico has a progressive income tax with rates that rank among the 20 lowest in the country. The Cost of Living Is Low.

New Mexico taxes Social Security benefits pensions and retirement accounts. Established a 39 flat income tax rate and eliminated state tax on retirement income in 2022. Overview of New Mexico Taxes.

Beginning in 2022 up to 10000 of military retirement is tax-free. Does New Mexico tax Social Security or pension. Will be subject to a 59 percent tax rate.

New Mexico is one of 12 states that tax Social Security at some level. The state also provides an income tax exemption of up to 3000 to those 65 and older for. Beginning with tax year 2002 persons 100 years of age or more who are not dependents of other taxpayers are exempt from filing and paying New Mexico personal income tax.

New Mexico does have a state income tax. Social Security retirement benefits are taxable in New Mexico but they are also. New Mexicos law says every person who has income from New Mexico sources and who is required to file a federal income tax return must file a personal income tax return in New.

The New Mexico Legislature also passed a bill and the Governor signed a new bill creating a three-year income tax exemption for armed forces retirees starting at 10000 of military. 800-352-3671 or 850-488-6800 or. New Mexico allows you to exclude your retirement income of up to 8000 based off of your filing status and your federal adjusted gross income if you meet one of the following.

The state of New Mexico provides several veteran benefits. This page explains those benefits. The states average effective property tax.

Beginning with tax year 2022 most seniors will be exempt from paying taxes on their Social Security benefits when they file their New Mexico Personal Income Tax returns. Compared to many other popular retirement. Is Social Security taxable in New Mexico.

This is meaningful tax relief that. 404-417-6501 or 877-423-6177 or. Permanently exempted groceries from the state sales tax in 2022.

In late 2021 North Dakota eliminated the tax on Social Security benefits. 52 rows Tax info. During the 2020 legislature bills were introduced on Think New Mexicos three recommendations to improve retirement provision in New Mexico.

In states that do not tax. New Mexico is well known for its low costing of living which is 31 lower than the average in the United States. A three-year income tax exemption for armed forces retirees starting at 10000 of military retirement income in 2022 and rising to 30000 of retirement income in tax year 2024.

New Mexico Retirement Tax Friendliness Smartasset

Historical New Mexico Tax Policy Information Ballotpedia

How Every State Taxes Differently In Retirement Cardinal Guide

Portugal Pension Income Tax Of Non Habitual Residents Kpmg Global

:max_bytes(150000):strip_icc()/5ToolsforRetirementPlanning-3954dc7e62a04daea0c47422dd74d33d.jpg)

State Income Tax Breaks For Retirees

Taxation In New Mexico Wikipedia

States That Don T Tax Retirement Income Personal Capital

States That Don T Tax Military Retirement Turbotax Tax Tips Videos

New Mexico Eliminates Social Security Taxes For Many Seniors Thinkadvisor

How Is New Mexico For Retirement

New Mexico Retirement Guide New Mexico Best Places To Retire Top Retirements

Retiring These States Won T Tax Your Distributions

15 States That Don T Tax Retirement Income Pensions Social Security

6 Pros And Cons Of Retiring In New Mexico 2020 Aging Greatly

A Guide To New Mexico S Tax System New Mexico Voices For Children

Social Security New Mexico Moves Closer To Eliminating Taxes On Most Social Security Benefits Gobankingrates

37 States That Don T Tax Social Security Benefits The Motley Fool

Pension Tax By State Retired Public Employees Association

The 10 Best Places To Retire In New Mexico In 2022 Personal Capital